The Importance of Renters Insurance

Published: 09/23/24

Updated: 04/22/25

We’ve all seen GEICO, Progressive or State Farm commercials. They and many other insurance companies grab our attention with flashy ads on TV and online all the time. These commercials primarily focus on car or homeowners insurance, often leaving renters insurance in the shadows. But let’s make one thing clear: if you’re living in an apartment, you need renters insurance.

Renters account for 34% of occupied housing or 45,221,844 total homes throughout the United States. As home prices have surged by 47% since 2020, almost 50% of those units are rented by Millennials and Gen Z. So if you’re in one of those groups, you’re likely looking for (or have already found!) an apartment or other rented space to call home.

While renters may not need to purchase homeowners insurance, our apartments are still filled with everything we own—or at least everything we need, with the rest stored away safely elsewhere. But without homeowners insurance, how do you make sure your belongings are protected? While we all hope for the best, what if tragedy strikes one day? A fire, a flood or any other kind of unforeseen disaster could easily destroy the possessions we both love dearly and need to survive. Fortunately, as long as we have renters insurance, getting everything back is much easier.

What is Renters Insurance, and Why Do You Need It?

It’s a common misconception that your property management’s insurance covers everything inside the building you rent space in—but this is not the case. A property’s homeowners insurance covers the building, but because the landlord does not own the items in your apartment, it falls to you as a tenant to insure your own belongings. Enter: Renters insurance, because it does just that.

Did you know? Renters insurance typically insures your belongings wherever they are, even in a separate storage space.

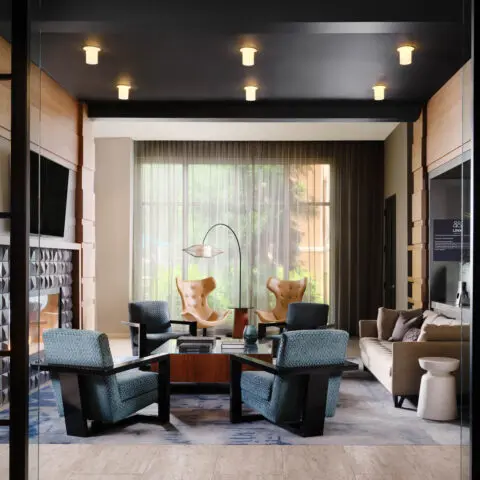

Imagine the worst-case scenario: you’re out enjoying a long-awaited night with friends at a restaurant. After a wonderful evening, you return to your apartment only to discover that you can’t get within a block of the building because someone left the oven on, and, well…fire spreads.

Many of us have valuable possessions in our homes—from family heirlooms and personal computers to cherished hobby collections—each with varying significance and worth. While some items are irreplaceable and hold sentimental value that can’t be quantified, others come with a substantial price tag. Essentials like clothing, food and household items, as well as tech devices, can quickly add up in value. Renters insurance provides peace of mind, ensuring that if your property is damaged by a covered event, the insurance company will help you replace it. Moreover, it can assist with temporary housing while you find a new place to settle after an incident.

Did you know? Many apartment complexes, including Veris communities, require renters insurance as a condition of your lease!

While new renters may find this overview beneficial, seasoned renters can also gain valuable insights by considering often-overlooked factors. For instance, think about the value of personal belongings. Hobby collections—like rare coins, vintage toys or old video game consoles—may not have cost much when purchased, but their value tends to increase over time. Assessing items at their “replacement value,” or the cost to buy new equivalents today, can help prepare for unexpected events. Regularly tracking this information is wise, and keeping receipts can be helpful as well!

How Much is Renters Insurance?

Different insurance plans can be expensive, and not everyone has room in their monthly budget for extravagant plans. Fortunately, renters insurance isn’t nearly as expensive as something like car insurance.

According to NerdWallet, the national average for the annual cost of renters insurance is $148. That’s only $12 a month. Of course, this can vary based on the state we live in. Some states like Iowa and Alaska have an average monthly cost of $8-9, whereas places prone to natural disasters, like Louisiana and Mississippi, are often above $20. Compare this number to car insurance, which has an annual national average between $637-$2,299. The cost of renters insurance is closer to that of a streaming subscription than to that of a traditional insurance policy.

But of course, the million-dollar question is: “Where can I get the best deal?” Just like in every other business, some insurers will cut us a great deal and others might look to reach as deep in our pockets as they can. So how do we pick the right insurance company?

Well, that depends on what you’re looking for. NerdWallet compiled a list of the best agencies on the market for renters insurance, choosing based on a variety of factors, including coverage options, median rates, complaint data, average discounts and offers and how easy it is to file a claim.

NerdWallet and other sites like it are a great place to find exactly what you’re looking for without having to research providers individually. You can narrow your search based on your desired coverage and compare average rates across organizations, eventually looking deeper into the companies that strike your interest.

We all go through life hoping nothing bad will happen. However, the unfortunate truth is that accidents can and do happen. Forgive the cliché, but it’s better to be safe than sorry! Renters insurance simplifies two crucial aspects: the process of renting an apartment and the recovery process if the worst should happen. This peace of mind is often worth the investment!